Welcome to the Century Mining Blog. This blog is open for viewing to the general public, but posting is restricted to Blog Members. If you wish to become a Blog Member send an email request to centurycarib@gmail.com. Comments by the viewing public has been reinstated. Check out the Information Links down the right-hand side.

Thursday, April 30, 2009

Century Mining Announces Late Filing Of Annual Financial Statements

The Company cited numerous changes, including the appointment of new auditors of the Company, the settlement of various debts and the appointment of a new Financial Officer in Peru, all of which contributed to the delay in filing. Specifically, Century was unable to fund the auditors of the Company in a timely manner due to a lack of working capital. This issue has since been resolved, and Century is working with the auditors to expedite the completion and filing of the financial statements and MD&A.

The Company made every effort to file the financial statements and MD&A by the prescribed deadline of April 30, 2009, but it has been determined by the Company and its auditors that no amount of effort will overcome the delays caused by the changes described above.

Century currently expects to file the Company's financial statements and MD&A on or before May 15, 2009. The Company also confirmed that it will provide default status reports so long as it remains in default of its requirements to file the financial statements and MD&A within the prescribed period of time.

Century confirmed that the delay in filing the Company's financial statements and MD&A will have no adverse effect on the Company's current financing initiatives as described in a separate press release issued on April 28, 2009. Furthermore, the financial statements do not contain any material gains or write-downs from the third quarter 2008 financial statements. Century also stated that there is no other material information concerning the affairs of the Company that has not been generally disclosed as of the date of this press release.

About Century Mining Corporation

Century Mining Corporation is a junior gold producer. The Company owns and is working towards the restart of the Lamaque mine in Québec that historically has produced over 9.2 million ounces of gold. In Peru, Century wholly-owned subsidiaries own an 82.6% interest in the San Juan Mine where the Company accounts for 100% of gold production. Total gold production for 2006 and 2007 was 70,401 ounces and 63,124 ounces of gold, respectively.

"Margaret M. Kent"

Chairman, President & CEO

Posting Rules Reminder

I do want to remind those who publish comments that the Blog requires you use choose a posting name. The Header for the Century Mining Blog states:

"Viewers may however leave comments on any post, but you must use a unique name (anonymous posts are subject to deletion)."

In practical terms, this is desirable so that when one responds to a comment from a poster, they can address that poster by name.

For instance, the last anonymous post said:

it is like dangling a red flag in front of our PK raging bull. they approached CMM and visited. PK had to contain the share price while they talk, or risk losing them. that's my theory. :)

To this anonymous poster I would say that while your info about the identity of the possible merger candidate may be possible, I would say that it makes no sense for PK to contain the share price. On the contrary, if you are negotiating a merger, you want your market cap to be as high as possible to negotiate to the most favourable percentage split.

This blog was created last year as a refuge from the Stockhouse Century Bullboards with a prolific amount of bashing, especially by one multi-alias basher in particular. Comments have in the past been subject to moderation and will be again to disallow posts that offer no value, like the ALL CAPS post from another "Anonymous" poster today.

So if commenting on a post, before hitting the Post button, click on the "Name/URL" button and enter the name you wish to post under.

If you wish to post an original post (rather than just comment on someone else's post), you must become a blog member. To become a member, send me an email to centurycarib@gmail.com. Members have much better posting tools available and you can edit your own posts after they have been posted. Member's posts are not moderated.

Quick thought on upcoming Y/E financials

We posted a net income of $.6M for Q3'08. The net income was $1.3M for the first 9 months of 2008. Of note, there was a $2.6M, one time, transaction gain in either Q1 or Q2 of 2008. Nonetheless, it means we have a $1.3M cushion to work with and still break-even for the entire 2008 fiscal year. It's possible, but it's going to be a challenge. Some of the loss incurred in closing off the hedged position (in 2008) will be booked in Q4 (some was previously booked in Q3 also). In addition, the gold price was relatively weak in Q4 (compared to other recent quarters). With San Juan having to support the entire company in Q4 (and for most of 2008) the leftover cash was insufficient to optimally operate San Juan. As such, both cash cost per ounce and production output likely suffered in Q4.

It is Y/E so it is possible to see Y/E adjustments also (i.e. adjustments to accounting accruals to better match expectations, which is something every company does before closing off Y/E). We also have new auditors this year. New auditors could sometimes bring new perspectives and maybe suggest new ideas. Century has also recently added a new Finance/Accounting expert (VP). He could have reommendations also.

Anyway, as mentioned, we have $1.3M to spare and still remain in a position to break-even in 2008. Even if we end up negative by a few million dollars for 2008, it doesn't really matter - we're all about closing off the financings right now. It would just be nice to show a net profit for 2008, especially with how challenging it was for us (and most companies) during 2008.

The Q1'09 financials will likely follow in the next 2 weeks to a month.

Tuesday, April 28, 2009

Century Mining Receives Conditional Underwriting Commitment For US$65 Million Lamaque Project Financing

Century is now proceeding with review of all necessary documentation and the formation of the operating subsidiary necessary to comply with the terms of the loan.

In addition to the $65 million debt financing, the Company is engaged in negotiations with two other separate parties regarding additional financing alternatives.

The two other potential deals under review include a merger with another resource company, whereby the combined entity would have sufficient capital to fund the restart of the Lamaque Mine and pay down the Company's liabilities and long-term debt, resulting in a significantly stronger balance sheet. The other scenario being considered by the Company's Board of Directors is a comprehensive agreement with a group of financiers for debt and equity financing for the Lamaque project, in addition to assistance with future capital requirements of the Company.

Century also clarified that the three alternatives are not exclusive of each other, and any combination of the $65 million debt deal and one of the two additional deals could be completed to form a well-funded mining house capable of funding current projects and pursuing other potential acquisitions.

Shares for Debt Arrangement

---------------------------

Century also announced today a shares for debt arrangement, whereby Century will complete a private placement of up to C$2.0 million in lieu of payment to certain creditors. Under the arrangement, Century will issue up to 8.0 million shares of the Company at an issue price of C$0.25 per share. This offering is being made available to various creditors of the Company for the purpose of reducing liabilities and immediately strengthening the Company's balance sheet and financial position. The shares will be subject to a hold period of four months and a day. The issuance of the shares is subject to compliance with applicable securities laws and the approval of the Exchange.

Margaret Kent, President and CEO of Century commented, "We are working diligently with all interested parties to thoroughly evaluate each of the financing alternatives available to Century. Management and the Board of Directors recognize the importance of concluding a financing deal expeditiously, but need time to negotiate and make the appropriate decisions, giving due consideration to all proposals. Regarding the shares for debt arrangement, many of the creditors that are participating in this offering will play a key role in the restart of the mine, and have supported the Company for the past year. We are happy that as key stakeholders they will recognize the potential upside when financing for the project is completed."

About Century Mining Corporation

Century Mining Corporation is a junior gold producer. The Company owns and is working towards the restart of the Lamaque mine in Québec that historically has produced over 9.2 million ounces of gold. In Peru, Century wholly-owned subsidiaries own an 82.6% interest in the San Juan Mine where the Company accounts for 100% of gold production. Total gold production for 2006 and 2007 was 70,401 ounces and 63,124 ounces of gold, respectively.

"Margaret M. Kent"

Chairman, President & CEO

Tuesday, April 21, 2009

Side note - 3.4M warrants set to expire

Thursday, April 16, 2009

Where Have All the Gold Mines Gone?

http://www.theaureport.com/pub/na/2479

Source: Brent Cook, Exploration Insights 04/14/2009

Near-Term Production

This year’s corporate mantra for a crowd of junior explorers and miners is quite simple: “get us some near term gold production fast” (or some variation thereof). The motive of course is pure: get the share price up. For companies with $2 million to $200 million in the bank the magic bullet to riches is perceived to be the acquisition of that one gold property or company that everyone else has missed. It’s a simple and easy to understand business plan that doesn’t take a genius to grasp – find it and buy it cheap while no one else is looking. I am personally aware of more than a dozen management teams pursuing this model and there are probably another 50 companies that fall into this category. I have also spent countless hours in the same search and come to the conclusion that everyone else hasn’t missed much. This particular path to corporate riches may turn out to be an elusive dream.

In this mass corporate dream the targeted gold acquisition “only” has to offer low cost production with exploration upside of a few million ounces. It should be located in a politically stable country with welcoming locals eager for the jobs a big hole in the ground will provide. A swimming pool and cold beer are also desirable attributes. Until this stealth opportunity arises, said new gold converts are cutting expenditures and shelving last year’s base metal projects until prices improve. You see, balance sheets alone cannot sustain a share price.

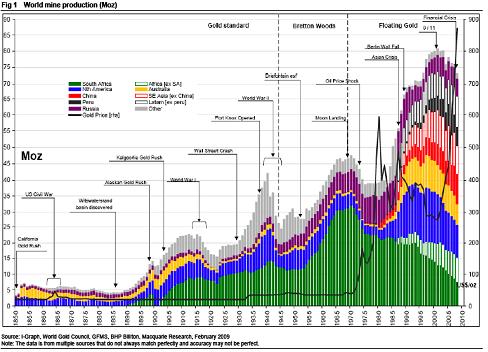

The problem we are all having is that quality economic gold deposits are few and far between. The most obvious confirmation of this claim is that world gold production has been steadily declining since it peaked in 2001 in spite of a nearly US$600 rise in the gold price (fig. 1 below). This goes against basic economic theory that rising prices should bring on more production and suggests a more fundamental problem in the gold industry. To wit, we are mining more gold than we are putting into production in spite of an estimated $US18 billion in gold exploration expenditure over the past five years (CIBC and Metals Economic Group).

(Fig. 1- World gold production. Source; Macquarie Research, 2009)

Global Gold Production: Down

Even more telling in the chart above is that production is declining in the historic major gold mining regions. These prolific regions: USA/Canada, Australia and South Africa have established and workable mining legislation, political stability, infrastructure, experienced mining personnel, access to capital and cold beer. For the most part it appears then that large new gold discoveries are going to come lacking at least one of the advantages just listed. This ultimately means that the deposits are going to have to offer significantly higher profit margins to compensate for the increased risks. It also means the timeline to production will more often than not be stretched over many years as political, bureaucratic and social issues are ironed out—or not. Needless to say, borrowing to build a billion dollar project in someplace like…say Angola, is going to be problematic even when the credit markets unfreeze. Net-net, gold production is unlikely to increase over the next several years at least.

Company Production: Down

There are more or less 30 major gold mining companies and untold junior companies that contribute to the roughly 74 million ounces of annual gold production. Many of the major mining companies are not keeping up with reserve replacement at their mines and are also showing declining production and reserve profiles. They have predominately been able to add ounces through acquisitions and by raising the gold price used in reserve calculations: essentially turning waste to ore. This increased gold price assumption directly translates into a lower average recovered grade and higher production costs. Margins are not expanding as one would expect due to the miners’ inability to add new high-grade reserves. CIBC World Markets calculates a four-year world recovered gold grade decline from 1.7g/t in 2004 to 1.4g/t in 2008. That’s about an $8.70 decline in the value of every tonne of ore blasted, hauled and processed.

On the acquisition side, much of the increased gold production and reserves has come by way of base metal production. When base metal prices were high, gold company production costs were lower and earnings strong due to the base metal credits. The collapse in base metal prices at the end of 2008 resulted in a remarkable 31% increase in gold production costs, according the World Gold Council figures. Lesson learned: henceforth, gold dominant deposits will command a premium.

Recognizing this lack of economic gold deposits there is a concerted effort afoot by the financial movers and shakers to cob a collection of smaller gold (and silver) producers together, creating larger producers. The idea is to tout these newly created mid-tier producers with increased “visibility” to a fresh and better-heeled audience (some might say suckers). Although this exercise will undoubtedly make money for the suits, brokers, and some shareholders, this can be more of a shell game than real wealth creation. The resultant new gold production is generally marginal at best and those buying into and financing said vehicles must make a conscious decision as to how many warts they are willing to overlook.

Experienced Explorers: Down

I have commented on the declining metal production and the 120 or so mine closures or delays previously. Layoffs within the industry are even worse now and are especially hard on the exploration end of the business. Major and junior companies are all cutting staff and contractors: Rio Tinto-14,000 gone; TeckCominco-1,400 gone; BHP-6,000 gone; Morenci Mine-1,550 gone; Stillwater-528 gone; Shore Gold-89 gone and the list goes on right down to the smallest exploration company.

Newmont Mining, “the company of choice”, is a particularly sad story. They recently raised $1.2 billion through equity and convertible notes at the same share price they traded at five years ago (see fig. 2 below). Keep in mind that over the past five years the gold price increased about $500 and they produced around 27 million ounces of gold. Newmont has fallen under the influence of accountants who are reorganizing the company (again) into four new “business centers” none of which are reporting to the VP exploration. They laid him off plus a good number of the exploration staff. Newmont’s five years of absolutely zero added shareholder value (price) despite a near doubling of the gold price points to the problem the industry as a whole faces finding new quality deposits. The fact that Newmont is cutting exploration staff suggests they don’t hold out much hope for future in-house discoveries.

(Fig. 2- Newmont Mining 5-year price chart)

We could easily see 25% of the mining industry out of work, which is a real shame given my next sentence. The pent up demand for near term gold production is not going to be satisfied through financial engineering. There are not enough economic gold deposits to go around, I’ve been looking. With declining metal prices and profits; decreased exploration staff and budgets; and increased exploration, development and production costs and timelines, the odds are stacked against a surge in new gold discoveries.

Who will make the Next Discoveries?

Nearly all the hard global economic statistics and gold supply-demand data I see points toward gold and gold companies being amongst the best performing investments over the next few years. Notwithstanding the time and effort involved, increased gold production will to a large degree have to come from new discoveries; we cannot keep kicking the same old dog properties. And, in spite of the hopes and wishes of many in the industry, sufficient cheap ready-to-go deposits just don’t exist. Given the profound difficulty of finding new gold deposits, the few lucky junior companies that are able to come up with a real gold discovery will reap dramatic share price increases.

The unlucky majority of juniors however are in for some bona fide rough times in finance world. Risk capital is tight and minerals exploration is a capital-intensive business: no capital-no business. So despite the need for new discoveries, we are going to witness the demise of many junior explorers as investors’ hopes fall in tandem with the share prices. I do not anticipate a sudden rush of money into the exploration sector that will raise all boats and certainly wouldn’t base any investments on that premise. Anyone subsidizing mediocre or low potential gold projects is probably doomed from the outset.

There is however no doubt that new gold deposits will be found. They are going to come from the hungry, intellectually astute and well-financed junior exploration companies, most of whom you have never heard of. The successful company management teams will be comprised of motivated people who are anxious to make their name in the mining industry. They will be bringing new ideas to old areas and old ideas to new areas. It is therefore imperative to focus on what appear to be legitimate, major gold discoveries and under-appreciated gold resources. Guessing won’t work in this market: economic and geologic reality is key.

Wednesday, April 15, 2009

Trade Summary for April 15

Saturday, April 11, 2009

More Century Press

http://www.mineweb.com/mineweb/view/mineweb/en/page67?oid=81673&sn=Detail

Here's an excerpt:

Century Mining stays on top; this week it announced high grade intercept results from exploration drilling at its existing Lamaque mine in Canada. Century is just one example of a stock price previously sold down to "priced to go bust" levels during the worst latter months of 2008. It secured financing, a key to recovery, around 31 March.

The key to the company's success still remains the closing of the previously announced financing that was estimated to close in approximately 21 days from March 24, which would be sometime this week if all goes well.

It is Jim Sinclair's opinion that many of junior gold companies have been beaten down to ridiculously low levels by naked short selling. He speculates that the reasons they haven't covered yet is to force predatory financing terms on those juniors that need to raise cash to survive. If that is the case with Century and PK does pull off this financing and there is a significant short position on Century, then we could see some short covering after the financing closes.

Looking at the trading patterns of Century's stock for the past 9 months, it didn't need short selling to drive it down to the low single digits as Wega took care of that, but it is interesting to note that they had an accomplice in Canaccord. Since June of 2008, Canaccord has had net sales of 22 million shares. This wasn't institutional sales either as the only remaining large institutional holder didn't sell their shares until last December when they sold their 11+ million shares to PK and RB.

I suspect that a substantial portion of the 22 million in net Canaccord sales were for clients that were shorting the stock.

Here's the text of the Jim Sinclair article:

Why would an organized short seller not cover in the marketplace even after having accomplished extremely low prices in Gold juniors?

The main purpose of this new multi-year attack of the entire investment group of junior exploration, development and even producing shares has as its goal “To prevent the field from obtaining financing.”

The plan of the organized shorts is not to re-buy their short positions back in the marketplace but rather to by preventing the companies from normal financing do the following:

1. Force by necessity the company to do participation financing on predatory terms on extremely exciting properties.

2. Force the company by necessity to do private placements with warrants and options that favored the private placee to the degree of dilution to the present stockholder that is egregious.

3. Force by necessity the company to accept loans terms based on their property sure to result because of short timeline in the failure on the note and title on the property to pass to the hands of the private loan note placement party.

This explains the enigma of no cover.

The strategy of defense has been to determine any and all other means of financing rather than the normal chain of broker dealer networks now making more money from the perpetrators than the operating companies.

http://www.jsmineset.com/

Thursday, April 9, 2009

The target date is quickly approaching

Back to our recent high grade drill results:

Agnico-Eagle is producing gold at Goldex for $24 Cdn ($19 US) per tonne. Remember, their reserve grade is only 2.05 g/t (or .07 oz/t). They are achieving such low cost per tonne through high volume bulk mining. Remember though, their low grade means that they have to go through 17 tonnes to produce 1 ounce of gold, thus their $323 US cash cost per oz in Q4. Having a grade of 1 oz/t only requires going through 1 tonne to produce 1 ounce.

As mentioned before, all of the 4 new high grade zones (5 of the 6 drill holes) at Lamaque show grades of close to 1 oz/t. We don't know what the final grade average will be for each zone (once the entire zone is fully drilled), but we know it will be high (some may even continue to be close to 1 oz/t). However, let's do a sensitivity analysis of the cash cost per oz of these zones, assuming 1 oz/t, .75 oz/t, .50 oz/t and .25 oz/t averages.

Let's use Goldex's Q4 result of $19 US cost per tonne. There doesn't appear to be any fundamental disadvantages with our 4 new high grade zones. None are located deeper than the Goldex reserves. Also, the thickness of our 4 new zones are better than vein thickness at Goldex, best I can see. In addition, we will likely perform high volume bulk mining also (assuming we firm up the deposits of course).

Remember, Goldex had to go through 17 tonnes to produce 1 oz of gold.

Using Goldex's cost per tonne, Lamaque's potential cash cost per ounce for each of our 4 high grade new zones (assuming we have success in firming up the deposits):

* @ 1 oz/t = $19 US cash cost per ounce

* @ .75 oz/t = $26 US

* @ .50 oz/t = $39 US

* @ .25 oz/t = $77 US

Remember, this is cash cost per oz for high volume bulk mining of ounces in these new high grade zones. Be it $19 or $26 or $39 or $77, it's all hugely profitable relative to a $900 gold price.

This is the potential of that last NR, just in case it wasn't quite clear.

Monday, April 6, 2009

Very impressive drill results

Five of the six drill holes are close to 1 ounce per tonne (this is enormous). Grades converted to ounce per tonne (from grams per tonne):

*drill hole #1243 - 1 oz/t

*#369 - .7

*#10875 - 1.2

*#1676 - .9

*#9251 - .8

*#9477 - .3

Historically, the Val d'Or area has realized great successes in mining high grade/narrow veins (well below 1 meter interval true thickness). Today's true thickness is significantly greater. Today's true thickness coverted to meters (from feet):

*drill hole #1243 - 4.9 meters

*#369 - 11.4

*#10875 - 1.8

*#1676 - 3.2

*#9251 - 4.5

*#9477 - 7.7

You combined the 1 oz/t result with the excellent thickness and you get a lot of gold within a space, which can be mined really cheaply.

Here are some other very positive points:

1) Holes 369, 10875, 9251 and 9477 are likely bulk mineable (the other 2 holes likely have bulk mining potential also)

2) The vast area around holes 369 and 10875 gives the impression of being interconnected with ore. The depth of hole 369 is 1704 ft and the depth is 1721 ft with hole 10875. The proximaty of these 2 holes (distance wise), and at similar depth levels, strongly suggests that ore continues between the 2 drill points. Also, there is a high probability that the ore extends from the main mine workings to these newly modeled intersections (as mentioned on the NR). Thus, all of this is giving me the impression that the connection of all these points (plus the ore depth, interval thickness and ore grade) provides high probability of this being a massive zone of high grade gold.

3) I see the area surrounding drill holes #9251 and #9477 having the exact potential as what I've described above (point #2).

4)Hole #1243 is only 113 meters down (345 ft) from the surface. As such, it represents yet another high grade area that can be mined early at Lamaque (if required).

Saturday, April 4, 2009

Results from our neighbour’s mine (Lamaque’s bulk mining potential)

*grade – 2.05 g/t (based on historical production, Lamaque’s bulk mining ounces will likely grade 4.5 to 5.5 g/t – gold grade more than twice as high as ounces at Goldex)

*location of gold reserves – about 1500 to 2300 ft down

*LOM expected cash cost per oz - $230

*Q4’s actual cash cost per oz - $323 (it will likely move lower, closer to the $230 target, once Goldex is fully ramped up)

*expected production – 160,000 ounces per year

Lamaque’s bulk mining potential:

1) bulk mining method may be possible with mining some zones identified in the Feb. 24’09 NR (“These newly defined dyke and shear structures indicate the presence of large virgin ore zones, which may be bulk mined within 2,000 feet of surface.”) – 1000 to 2000 ft

2) West Plug – 2800 to 5500 ft

3) Lamaque Main Plug – 4000 to 6000 ft

In addition, the Bedard Dyke appears to have at least 3 large high grade zones. The Bedard Dyke appears to start at the surface and go down to about 1000 ft.

The West Plug and the Lamaque Main Plug, combined, has potential for 2 million bulk mineable ounces.

We will likely not be able to begin upgrading (firming up) those 2 million bulk ounces for another 3 years. That’s alright though as we will not need those ounces for many years into the future (we have plenty of other economical ounces). Longer term though, those 2 million bulk mining ounces (once firmed up) should ensure Lamaque stays economically viable, under all gold price situations (even if by chance the gold price should happen to fall back to, say, $350 in 7 years time). Lamaque should be well positioned to succeed. It will help Century to ride out potential rough times in the gold price cycle, and become a multi-decade gold mining company (similar to what the LaRonde Mine did for Agnico-Eagle over the past couple of decades). This bulk mining contingency will eventually allow for greater long-term investor confidence in Century.

It may be possible to more rapidly access the bulk ounces (and high grade zones) located at 2,000 ft and below.

The ounces at Goldex are closer to the surface than most of the bulk mineable ounces at Lamaque, however, the much higher gold grade at Lamaque (relative to Goldex) should likely more than compensate for that shortfall.

I think it’s fairly reasonable to assume that cash cost per ounce for Lamaque’s bulk mineable ounces should be somewhat consistent with results being achieved by Goldex ($230 to $300 range) – perhaps even better.

Friday, April 3, 2009

AGM - held June 1, 2009 (Vancouver)

Date: 30/03/2009

510 Burrard St, 3rd Floor

Vancouver BC, V6C 3B9

www.computershare.com

To: All Canadian Securities Regulatory Authorities

Subject: CENTURY MINING CORPORATION

Dear Sirs:

We advise of the following with respect to the upcoming Meeting of Security Holders for the subject Issuer:

Meeting Type : Annual General and Special Meeting

Record Date for Notice of Meeting : 27/04/2009

Record Date for Voting (if applicable) : 27/04/2009

Meeting Date : 01/06/2009

Meeting Location (if available) :

Vancouver Club

915 W. Hastings St.

Vancouver BC

Voting Security Details:

Description CUSIP Number ISIN

COMMON 15662P101 CA15662P1018

Sincerely,

Computershare Trust Company of Canada /

Computershare Investor Services Inc.

Agent for CENTURY MINING CORPORATION

CMM closes remainder of FT financing

BLAINE, WA, April 3 /CNW/ - Century Mining Corporation (CMM: TSX-V) announced today that it has closed the remaining balance of a non-brokered private placement of 1,902,474 flow-through shares at a subscription price of C$0.13 per flow-through share for gross proceeds of C$247,321. Today's closing completes the flow-through financing originally announced on March 24, 2009 of 15,384,615 flow-through shares for total gross proceeds of $2.0 million.

About Century Mining Corporation

Century Mining Corporation is a junior gold producer. The Company owns and is working towards the restart of the Lamaque mine in Québec that historically has produced over 9.2 million ounces of gold. In Peru, Century wholly-owned subsidiaries own an 82.6% interest in the San Juan Mine where the Company accounts for 100% of gold production. Total gold production for 2006 and 2007 was 70,401 ounces and 63,124 ounces of gold, respectively.

"Margaret M. Kent"

Chairman, President & CEO

Wednesday, April 1, 2009

Updated technical report - Lamaque

Trading Summary for April 1

Fairly predictable market action today. After running up fairly quickly to 19 cents, the profit takers started hitting the bids and lowering the asks.

BMO Nesbitt had placed asks of 100,000 shares at the 15, 16, 18 and 19 cent levels in late February and when all of the 19-cent shares failed to sell today, they dumped another 200k shares at 16 to 17 cents.

TD has been a consistent profit taker the past week or more after accumulating over 8 million shares in Jan and Feb. UBS bought 100k shares at 14.5 cents on Friday and sold them today at 17 cents for a $2,500 gain.

It's all part of the normal process of moving higher and the new buyers will probably want much higher prices before they take profits.

Odds and ends

2) The Calgary investment conference is happening this upcoming weekend. Century's value proposition is becoming more compelling with each passing day. It's unclear if new folks will invest in Century via the conference, but at least Century can now paint a picture that most investors an relate to.

3) Based on a previous NR, it sounds like analysts were kicking Century's tires a little bit at the Toronto conference. I wouldn't be surprised if we finally get analyst coverage at some point down the road (after financing has been closed off and perhaps after some other improvements have been made).

4) Also, with financing and operational progress, both a TSX big board listing and a Lima listing may be possible. I think the TSX listing is way into the future, perhaps not until Lamaque is substantially ramped up and demonstrates solid performance results (including cash cost). I wouldn't be surprised if the Lima listing comes first. By the way, there are likely multiple ways of getting a Lima listing. I don't necessarily think it has to be by way of only the traditional method, as other ways may allow for 2 or 3 company goals to be achieved at the same time - I think our options are open.

5) I vaguely remember seeing a picture of an assay lab that is located at the Lamaque Complex, but I don't recall where I saw it (thus I don't know where to look to view it again). An active assay lab (if it exists and if they reopen it for this purpose) should help quite a bit with the exploration efforts. They will be able to get quicker results, thus be able to better pinpoint their targets. They would still need to send away for some independent confirmation (I assume), but an active in-house assay lab should still be of great assistance. They would also need to weigh the cost of reopening it versus the benefits gained.

6) Century had a couple of new drill rigs at Lamaque, but I will assume they had to send them back due to the 2008 credit situation (although I don't know). Nevertheless, it should be extremely easy to sign up a drill contractor these days, with what has happened to exploration companies over the past year. Also, Century should have absolutely no problems with hiring miners and purchasing/leasing mining equipment, once that time has arrived.

7) IQ was willing to reduce our LT Debt amount from $15M Cdn to $9M Cdn if the Fortis deal had gone through - if was their part to help us close off the Fortis deal, and thus create jobs in Quebec. It is not clear where they stand with this current (Union) deal. IQ's balance will be paid down at closing, but it's unclear what the amount will be. Let's hope we still get some sort of discount, as the extra money will provide more contingency down the road. (although I have said it many times before, I'll say it one more time) IQ has been a great partner, from what I can see. We have been fortunate to have them over the past year or two. IMO, they have contributed quite a bit to the success we are now beginning to realize. Perhaps they will continue to partner with us on new projects down the road.