Welcome to the Century Mining Blog. This blog is open for viewing to the general public, but posting is restricted to Blog Members. If you wish to become a Blog Member send an email request to centurycarib@gmail.com. Comments by the viewing public has been reinstated. Check out the Information Links down the right-hand side.

Thursday, December 31, 2009

TSX-V Bulletin update: "Ospraie not an insider"

BULLETIN TYPE: Private Placement-Brokered, Correction

BULLETIN DATE: December 31, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated December 30, 2009 with respect to the Brokered Private Placement announced September 15, 2009, November 2, 2009 and December 24, 2009, the Exchange has been advised that the placee Ospraie Equity Master Fund LP is not an Insider of the Company.

Wednesday, December 30, 2009

TSX-V accepts the non-conditional $17M PP for filing

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: December 30, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a Brokered Private Placement announced September 15, 2009, November 2, 2009 and December 24, 2009:

Number of Shares: 85,000,000 shares

Purchase Price: $0.20 per share

Warrants: 42,500,000 share purchase warrants to

purchase 42,500,000 shares

Warrant Exercise Price: $0.30 for an eighteen month period

Number of Placees: 3 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Kirkland Intertrade Corp. Y 78,750,000

Ospraie Equity Master Fund LP Y 5,000,000

Agents' Fees: $400,000 payable to Strategic Partners Ltd.

1,500,000 Agent's warrants payable to Union

Securities Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must issue a news release announcing the closing of the private placement and setting out the expiry dates of the hold period(s). The Company must also issue a news release if the private placement does not close promptly.

Tuesday, December 29, 2009

Scola owns 7 million shares

Immediately prior to the execution of the Subscription Agreement, Finskiy indirectly owned and/or controlled, together with joint actors, a total of 22,372,759 Common Shares, representing approximately 9.9% of the then issued and outstanding Common Shares, of which 7,142,857 Common Shares, representing approximately 3.2% of the then issued and outstanding Common Shares, were owned and/or controlled by Gravity Ltd. (“Gravity”), a company beneficially owned and/or controlled by Francis Scola. Immediately prior to the execution of the Subscription agreement, Finskiy did not, directly or indirectly, beneficially own or control any common share purchase warrants of Century.

Sunday, December 27, 2009

Scotia purchases (further thoughts)

Finskiy announced, during after hours on Dec. 24th, that he owns 42,372,759 Century shares .

The 20,000,000 difference is exactly what was purchased via the large private transactions overnight.

Meanwhile, during trading hours on the 24th, there were 1,369,000 gross Scotia share purchases (873,000 net).

The fact that Finskiy didn't include these Scotia purchases in his after hours share count number on the 24th would strongly suggest that it is not him buying shares via Scotia on the open market. Now, it might be possible that he is waiting 3 days for the transactions to clear before announcing, but I highly doubt it.

As a result, it appears as if the person (s) that has been purchasing millions of gross Century shares via Scotia over the past week represents a new institutional player.

As mentioned before, there are also signs that Finskiy previously purchased about 1.7M shares either on the open market or via a small private transaction. If he did it on the open market then the latest developments would suggest that it was unlikely associated with the Scotia purchases.

Saturday, December 26, 2009

Public (free) float analysis - 53.4% is the known public float, but perhaps 41.5% is the more realistic public float

Controlled by Finskiy and friends = 121,122,759 shares (35.9% - % diff versus Finskiy's 36.6% stated in his NR is related to IQ and Teck shares to be added to base)

Controlled by Scola (potentially) = 6,250,000 (1.9%)

Controlled by Peggy and Ross = 22,801,628 (6.8%)

Controlled by the Hampton Securities analyst (though doesn't fit the 5% cutoff definition) = 650,000 (.2%)

Controlled by IQ (though doesn't fit the 5% cutoff definition) = 5,000,000 (1.5%)

Controlled by Teck Resources (though doesn't fit the 5% cutoff definition) = 1,500,000 (.4%)

Issued and outstanding shares likely NOT available to the public = 157,324,387 (46.6%)

(121,122,759 + 6,250,000 + 22,801,628 + 650,000 + 5,000,000 + 1,500,000)

Known public (free) float = 180,175,613 (53.4%)

(337,500,000 total issued and outstanding Century shares after this upcoming week - 157,324,387 known shares unavailable to the public)

Further breakdown of the public float:

Estimated large holdings by retailers and a fund = AT LEAST 40,000,000 or 12% (almost half of this total is thought to be held by the fund)

A more realistic public float for Century Mining = 140,175,613 (41.5%)

(180,175,613 - 40,000,000)

Summary / Conclusion:

Although Century's official issued and outstanding shares will be approximately 337,500,000 after this coming week, shares available for public trading will have to come from a pool of ONLY about 140,175,613 shares (or perhaps much less).

Thursday, December 24, 2009

Excellent find Yikes1! - Finskiy currently officially owns 17.2% of CMM (20.5% FD basis)

The Canadians benefit because they get to take advantage of the Canadian tax benefits. Finskiy benefits because he gets a $.04 per share discount. Century benefits because it ensures we get $.20 per share via the FT (when the share price was trading at $.16 at the time and Finskiy, being Russian, likely has no use for Canadian tax benefits in 2009).

This now means that Finskiy already (officially) owns 17.2% of Century (42.3M shares), even before the final close out next week. If the market had any hesitations about Finskiy not being fully committed then this should erase that. There is no way he is not going to ensure Century gets fully financed (one way or another) when he already owns 17.2% of the company.

Yikes1, thanks for bringing this to my attention. Here is the full News Release by Finskiy:

December 24,2009

Acquisition of Securities of Century Mining Corporation

TORONTO, ONTARIO - (Marketwire - Dec. 24, 2009) - Maxim Finskiy ("Finskiy"), Voznesensky Pereulok 22, 125993 Moscow, Russia, announces that a company wholly-owned by him has acquired 20,000,000 units of securities (the "Units") of Century Mining Corporation, ("Century") at a price of $0.16 per Unit (the "Acquisition") pursuant to two private transactions. Each Unit is comprised of one common share of Century and one-half of one common share purchase warrant (each whole common share purchase warrant, a "Warrant"). Each Warrant entitles the holder to purchase one common share at a price of $0.30 for a period of 18 months.

Prior to the Acquisition, Finskiy indirectly owned and/or controlled, together with joint actors, a total of 22,372,759 common shares of Century, representing approximately 9.9% of the then issued and outstanding common shares. Following the Acquisition, Finskiy indirectly owns and/or controls, together with joint actors, a total of 42,372,759 common shares of Century, representing approximately 17.2% of the issued and outstanding common shares and, assuming exercise of all of the Warrants indirectly acquired by Finskiy pursuant to the Acquisition, 52,372,759 common shares of Century, representing in aggregate approximately 20.5% of the issued and outstanding common shares, calculated on a partially diluted basis (not including the exercise of any other securities convertible into common shares held by any other holder).

As announced in a press release dated December 23, 2009, pursuant to a subscription agreement between a company wholly-owned by Finskiy and Century, Finskiy may indirectly acquire an additional 78,750,000 Units (the "Additional Units") at a price of $0.20 per Unit pursuant to a private placement (the "Private Placement"). Following Finskiy's indirect acquisition of the Additional Units, Finskiy will indirectly own and/or control, together with joint actors, a total of 121,122,759 common shares of Century, representing approximately 36.6% of the issued and outstanding common shares and, assuming exercise of all of the Warrants comprising part of the Units and Additional Units indirectly acquired by Finskiy, 170,497,759 common shares of Century, representing in aggregate approximately 44.8% of the issued and outstanding common shares, calculated on a partially diluted basis (not including the exercise of any other securities convertible into common shares held by any other person). The Private Placement is subject to a number of conditions precedent and there can be no assurance that the Private Placement will close on the terms described above or at all.

Finskiy acquired the Units for investment purposes. Finskiy and the joint actors may, in the future, increase or decrease their respective ownership of securities of Century, directly or indirectly, from time to time depending upon the business and prospects of Century and future market conditions.

An early warning report (the "EWR") will be filed on SEDAR and will be available for review at www.sedar.com under Century's profile. A copy of the EWR can be obtained from the contact below.

Andrey Shchetinin

What a difference a year makes

- A new Board of Directors with a new Chairman

- The re-start of Lamaque

- Drill results from Bedard Dyke which will eventually increase resources

- Results of modelling work to add resources and convert resources into reserves

- A TSE listing

- increased production from San Juan now that development funds are available

- a continuing bull market for gold (Gold back over $1,100 today)

Best Wishes to all for the Christmas Season and a Bright and Prosperous New Year!

Breakdown of the $21M PP

$4M of the $21M was FT (fully closed off today)

$17M (confirmed in today's NR) of the $21PP is remaining (to be fully closed off and funds delivered next week)

Finskiy said he went for 78,750,000 shares = $15,750,000

$17.0M - $15.75M = $1.25M

Someone else subscribed to the $1.25M or 6,250,000 shares.

Scola?

Century Mining Signs Debt and Equity Agreements for Financing and Closes Flow-Through Financing

Due to the signing of documentation for the above financings immediately prior to the Christmas / Boxing Day holiday weekend, the final closing and disbursement of funds to the Company cannot be completed until the week of December 28, 2009. A subsequent detailed press release will be issued at that time highlighting all terms of the completed financings.

"The signings of the prepaid gold forward agreement and the equity subscription agreements are major milestones for the Company and all of its stakeholders. With the funding of these financings next week, we will have achieved the final step to allow the Lamaque Gold Project in Val d'Or, Quebec to advance towards production in early 2010. On behalf of the Board of Directors and the management team, I would like to thank all our stakeholders for their support and strong vote of confidence in our company. Upon funding, Century will immediately pay the remainder of CDN$3.5 million financial guarantee requested by the Ministry of Natural Resources of Quebec for the reclamation of the Sigma site," commented Margaret M. Kent, President and CEO of Century Mining.

The Company also wishes to announce that it has closed the last flow-through equity financing, comprising 20 million units at a price of CDN$0.20 per share for gross proceeds of CDN$4.0 million. Each unit consists of a common share issued on a flow-through basis and one-half of a common share purchase warrant, with each full warrant exercisable for 18 months at a price of CDN$0.30. This financing was originally announced on November 27, 2009.

All of the securities issued under these private placements will be subject to a four-month hold period.

"We are very pleased to have completed this last tranche of flow-through financing. This $4 million allows the Company to continue its exploration, development, and resource delineation program at the Lamaque Gold Project. The Board of Directors would like to wish all of our stakeholders a happy holiday season, and we look forward to making 2010 a very prosperous year for our company. We will schedule a conference call for early January 2010, once funding is completed," added Ms. Kent.

About Century Mining Corporation

Century Mining Corporation is a Canadian-based gold producer with expanding gold production, late stage development and exploration properties, and holds strategic land positions in Canada, Peru, and the United States. The Company's strategy is to grow into a mid-tier producer through organic growth via existing mine expansions, and by pursuing other strategic and synergistic gold mining acquisitions.

On behalf of Century Mining Corporation,

Margaret M. Kent, President & CEO

Wednesday, December 23, 2009

Did Finskiy and friends buy a few shares on the open market?

He says that they currently control 22,372,759 Century common shares.

Here is a reconciliation of what we know and what we have a pretty good idea of:

*Finskiy purchased 7,142,857 Century shares in a private transaction back in September

*Finskiy and friends added 78,750,000 Century shares via this major transaction

*Finskiy and friends likely added 13,500,000 via the $2.7M bridge equity FT transaction in November - Finskiy stated via articles (at late November, after this $2.7M financing) that him and his associates controlled close to 10% of Century shares (this was the only avenue for one primary buyer to pick up 13.5M Century shares between mid Sept and late Nov)

7,142,857 + 78,750,000 + 13,500,000 = 99,392,857

101,122,759 - 99,392,857 = 1,729,902

As you can see, I cannot account for 1,729,902 of Finskiy's shares.

Now, here is an important hint to guide us.

With warrants, Finskiy expects to get to 140,497,759 Century FD shares.

140,497,759 - 101,122,759 = 39,375,000 warrants

78,750,000 / 2 = 39,375,000 warrants

It means that all the warrants came from 78,750,000 shares. This means that Finskiy and his friends did not acquire the extra 1,729,902 Century shares via a financing with warrants (i.e. the $4M financing that got approved by TSX-V today).

Also, the $1.3M original portion of the bridge financing (which didn't have warrants) was via Union Securities so Finskiy and his people likely did not participate in that either.

That only leaves Finskiy with 2 avenues for buying the 1,729,902 extra shares:

1) another private transaction

2) open market

Was he the Scotia person buying on the open market in recent days?

I have have absolutely no idea, but it doesn't seem we can rule it out either.

Maxim Finskiy Agrees to Acquire Securities of Century Mining Corporation

Dec 23, 2009 18:19 ET

TORONTO, ONTARIO--(Marketwire - Dec. 23, 2009) - Maxim Finskiy ("Finskiy"), Voznesensky Pereulok 22, 125993 Moscow, Russia, announces that a company wholly-owned by him has entered into a subscription agreement to purchase 78,750,000 units of securities (the "Units") of Century Mining Corporation, ("Century" or the "Company") for the subscription price of $0.20 per Unit pursuant to a private placement (the "Private Placement"). The closing of the Private Placement is subject to a number of conditions precedent. Each Unit will be comprised of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant, a "Warrant"). Each Warrant will entitle the holder to purchase one common share at a price of $0.30 for a period of 18 months from the date of issuance of the Warrant in accordance with its terms.

Finskiy currently indirectly owns and/or controls, together with joint actors, a total of 22,372,759 common shares of the Company, representing approximately 9.9% of the currently issued and outstanding common shares. Together with the securities he will indirectly acquire pursuant to the Private Placement, Finskiy will indirectly own and/or control, together with joint actors, a total of 101,122,759 common shares of the Company, representing approximately 32.5% of the issued and outstanding common shares and, assuming exercise of all of the Warrants to be indirectly acquired by Finskiy pursuant to the Private Placement, 140,497,759 common shares of the Company, representing in aggregate approximately 40.1% of the issued and outstanding common shares, calculated on a partially diluted basis (not including the exercise of any other securities convertible into common shares held by any other holder).

Finskiy has agreed to indirectly acquire the Units for investment purposes. Finskiy and the joint actors may, in the future, increase or decrease their respective ownership of securities of the Company, directly or indirectly, from time to time depending upon the business and prospects of the Company and future market conditions.

An early warning report (the "EWR") will be filed on SEDAR and will be available for review at www.sedar.com under the Company's profile. A copy of the EWR can be obtained from the contact below.

For more information, please contact

Andrey Shchetinin

+7495 287 2951

TSX-V accepts the $4M financing (this is the one I've been waiting from the Nov. 26th NR - it's part of the $21M major PP)

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 23, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to a Non-Brokered Private Placement announced November 26, 2009:

Number of Shares: 20,000,000 shares

Purchase Price: $0.20 per share

Warrants: 10,000,000 share purchase warrants to

purchase 10,000,000 shares

Warrant Exercise Price: $0.30 for an eighteen-month period

Number of Placees: 17 placees

Finder's Fee: $160,000 cash and 800,000 warrants payable to

Oberon Capital Corporation

- Finder's fee warrants are exercisable at $0.20 per share for an eighteen-month period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must issue a news release announcing the closing of the private placement and setting out the expiry dates of the hold period(s). The Company must also issue a news release if the private placement does not close promptly. Note that in certain circumstances the Exchange may later extend the expiry date of the warrants, if they are less than the maximum permitted term.

Scotia continues to buy - 24% buys of Century traded shares over the past 7 days has been done by Scotia (not including today's heavy Scotia buys)

It's impossible to know if it's an institution that is accumulating these Century shares. However, as Carib noted, it appears to be an institution. You almost never see retail investors gobble up such large quantity of shares with each transaction, and so many frequent large transactions, and for so many continuous trading days. It's still positive if it's a large retail shareholder or a few large retail shareholders, assuming they are taking a long-term view of the company - with such a large investment, the accumulated shares will likely not be used for day trading purposes.

Tuesday, December 22, 2009

Monday, December 21, 2009

Today's Trade Summary

Rating change from TD Alerts

CMM-X: The overall 5-Star Rating of Century Mining Corp. (CMM-X) has changed

CMM-X Recommendation upgrade.

CMM-X

5-Star Rating (new): *****

5-Star Rating (previous): ****

Saturday, December 19, 2009

Summary of TSX-V approvals

1) All transactions involving the issuance of new shares likely require separate TSX-V approval.

2) The key (if not all) liens on Century assets likely required elimination prior to the $33M deal closing with the International Bank – banks typically like Balance Sheets (and asset claims) of junior companies to be clean and tidy prior to closing debt financing deals.

Summary of transactions requiring/likely requiring separate TSX-V approval prior to the major deal closing:

1) The IQ Debt retirement proposal (issuance of 5M shares) has already been approved by the TSX-V.

2) The $21M PP financing has already been approved by the TSX-V. There may be other minor customary conditions (per note below), but I believe the primary conditions set out by the TSX-V have been pretty much addressed. The voting was 99.23% in favour of the deal so I don’t see disinterested shareholders’ approval as being an issue.

PP Circular, SEDAR, Oct. 29’09:

“Exchange Approval

The Exchange has provided its conditional acceptance to the Private Placement subject to the Company obtaining disinterested shareholders’ approval on the creation of new Control Persons and other customary conditions of the Exchange, including the Company issuing a press release with respect to increasing the size of the Private Placement from $20,000,000 to $21,000,000.”

On Nov. 26, Century issued an NR about $4M of the $21M (which was expected). Now, here is where it gets a bit confusing to me. It’s not clear if the $4M needs an additional approval from the TSX-V (even though it was already part of the $21M approved). The Nov. 26 NR stated that the $4M is subject to TSX-V approval. It could be that they were referring to the (bigger) $21M conditional approval process.

It has been over 3 weeks since that Nov. 26 NR was issued and I still haven’t seen TSX-V issue a separate bulletin note about the $4M. Also, Century hasn’t closed off the $4M via separate NR either. Perhaps they are still treating the $4M as part of the $21M for TSX-V approval and close off purposes.

3) Royalty buyout from Teck Resources. The December 24th major financing close off could become a tight squeeze due to this transaction. With 1,500,000 shares being issued, (using our conclusions from above) it could invoke separate approval from the TSX-V. The NR was issued this past Wednesday (2 or 3 business days ago). Can we get approval by the TSX-V on Monday, Tuesday or Wednesday of next week – leaving just enough time for final circulation and approval of the overall package by all parties? It’s possible, but it might be out of Century’s control. Now, TSX-V has a process where companies can file for expedited approval by the TSX-V. Hopefully Century has used the expedited filing approach.

Also, if TSX-V approval for this item is not received in time then can Century just go ahead and close off the larger financing anyway, as this is a minor item (no reason for TSX-V to not approve)? That might be a possibility (I think) as the royalty deal between the key parties has already been agreed to (which is the key). For example, I think small cap companies sometimes spend money from financings as soon as the cash is received due to the level of urgency (then they receive the TSX-V document a few weeks later).

Another option is that they can still close the deal on Dec. 24th with a condition written into the documents stating that money will be released once TSX-V approves the Teck Royalty buyout proposal. Then, the money gets released at the point of TSX-V approval in a week or two later. Theoretically, this should not be a show stopper for the 24th, but only if all parties are willing to participate of course (otherwise it could result in a slight delay).

Off the top of my head, (baring surprises) I don’t see any other remaining transactions that would require both the issuance of new shares (thus requiring TSX-V approval) and needing elimination from the Balance Sheet (or elimination of a claim) to close off the bank deal. I can’t see Century issuing shares for the $1M (potentially) unsecured MRI debt.

Friday, December 18, 2009

TSX-V accepts the IQ debt retirement proposal for filing

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: December 18, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to issue 5,000,000 shares at a deemed value of $0.20 per share to settle outstanding debt for $7,622,014 (out of $16,372,014 debt, balance will be paid in cash).

Number of Creditors: 1 Creditor

The Company shall issue a news release when the shares are issued and the debt extinguished.

Mark Lackey, senior vice president, Hampton Securities.

Fast forward to 5:15

BNN Video Clip

"I couldn't find another company like that..."

30 seconds of BNN TV coverage for Century Mining

The Hampton person is named Mark Lackey. He talks about Century around the 11:50 - 11:55 am timeframe.

The video should be posted shortly (not posted as yet). You will need to click on "TV Clips" then select the appropriate video from the new page.

http://www.bnn.ca/

Thursday, December 17, 2009

Today's Trade Summary

A quiet day for Canaccord and Anonymous on a fairly high volume day. It seems like there is some profit taking going on from buyers that bought early in the year. UBS, the biggest seller today had net purchases of 766,509 shares at an average cost of 6.8 cents in the January - May period. That's a 4-bagger, so selling 300k now locks in considerable profits and makes the rest of the shares free. Likewise Research Capital who has sold 279,500 shares the past two days picked up some cheap shares early in the year. In the Jan-May period they had net buys of 654,000 at 7.7 cents. See the 2009 Trading summary link on the right for the numbers.

Only 6 business days remaining for the documentation finalization process (including today)

Off the top of my head, it appears as if most of the complex liens on Century assets and other creditor situations have already been negotiated:

*the IQ buyout deal is set

*the Teck royalty buyout deal is now set

*there appears to be an understanding with Gerald Metals with regards to the $2.6M payment timeframe (upon closing of financing)

*the $1M owed to MRI appears to be unsecured (so no liens), but it's possible that the international bank might still prefer to see a settlement first before closing the financing deal (I have no idea). Perhaps Century should try to settle for something like $750K (a win/win figure, since MRI's actions resulted in damages to Century). MRI might play hardball and insist on $1M - if such is the case then I hope the international bank would disregard this item for the closing, especially since it's likely an unsecured item. I guess we'll eventually see.

*the $3.5M environmental bond has already been paid to Quebec

*payables are unsecured liabilities (and we already know a chunk of the payables will be eliminated once financing is in place

There are a few other very minor Balance Sheet items that may need to be looked it, but no show stoppers. Unless there are any major surprises I am not aware of, there should not be any Balance Sheet items (secured or unsecured) or liens on Century assets to prevent documentation flow. I guess we will know in time.

2) There was a sign yesterday that the new IR guy has started. Century's NR was distributed via Market Wire and Marketwire Canada, instead of usual CNW. It's not clear if this was a permanent move or just a one time experiment. It's also not clear if the move was made due to the new IR guy being more familiar with Market Wire and Marketwire Canada or if it's due to the new service having greater distribution. Perhaps it's a bit of both. The new guy is from Hawthorne Gold, and previously El Dorado Gold. Hawthorne Gold was using Market Wire and Marketwire Canada up until November 20'09, when they switched over to CCNMatthews. That's likely about the time period he departed Hawthorne.

Let's hope he's working on an improved website and a new Corporate Presentation for Century. More importantly, let's he is working on rolling out a solid plan to reconnect Century to institutional investors.

Wednesday, December 16, 2009

Century Mining Appoints Senior Operating Manager for the Lamaque Gold Project & Provides Financing Update

Mr. Keller brings over 25 years of extensive operational, engineering, and mine development experience. Mr. Keller recently held the position of COO, VP Operations for Crowflight Minerals Ltd., and previously held other senior mine management roles with Williams Operating Corporation, Teck-Corona Operating Corporation and Rio Algom Limited. Mr. Keller brings a solid track record of mine start-ups from construction to production, mine and mill facility design, optimization of engineering operations, improved safety and cost reductions primarily for underground mining operations. Mr. Keller is a Professional Engineer (P.Eng, Mining) registered in Ontario and Manitoba, and will be commencing employment immediately with Century.

"Paul Keller, as our senior operating professional in Val-d'Or, will play an integral role in the advancement and start up of the Lamaque Gold Project in Québec, Canada. Paul brings a wealth of underground mine engineering and development experience, a hands-on management style and team leadership approach that fit well into our mining group. Century is pleased to have Paul join our team as we continue to take the steps to commence production by the summer of 2010. Mine development will commence as soon as the mine financing is complete," commented Margaret Kent, President & CEO of Century.

Century Purchases Remaining Royalty Interest

Century and Teck Resources Limited ("Teck") have agreed to eliminate all royalties and future payments that may affect portions of the Lamaque underground mine owned by Century. Upon receipt by Teck of 1,500,000 common shares of Century and CDN$750,000, Century and Teck have agreed to terminate Teck's royalty agreement and eliminate all purported obligations in favour of Teck including, without limitation, any obligation of Century to pay Teck any future royalties from the Lamaque mine.

Century Updates on Closing of Financing

Management continues to finalize the completion of documentation and closing of the previously reported US$33 million prepaid gold facility with a major international bank and the $21 million private placement. Further to previous press releases, the Company expects that the closing of these financings will be prior to December 25, 2009.

About Century Mining Corporation

Century Mining Corporation is a junior gold producer. The Company owns and is working towards the start up of the Lamaque Gold Project in Québec, Canada that historically has produced over 9.2 million ounces of gold. In Peru, Century's wholly-owned subsidiaries own an 82.6% interest in the San Juan Mine, where the Company accounts for 100% of gold production. Total gold production for 2007 and 2008 was 63,124 and 14,252 ounces of gold, respectively.

On behalf of Century Mining Corporation,

Margaret M. Kent, Chairman, President & CEO

Tuesday, December 15, 2009

Today's Trade Summary

Monday, December 14, 2009

Friday, December 11, 2009

Thursday, December 10, 2009

Today's Trade Summary

Wednesday, December 9, 2009

Tuesday, December 8, 2009

Good point made by a Chinese Assistant Professor, published in a tightly controlled Chinese newspaper

The Chinese Assistant Professor does a good job in making the case in the following article:

Official Chinese paper calls for more gold reserves

By: Reuters

8th December 2009

BEIJING - China should increase the proportion of gold in its foreign exchange reserves to ensure the safety of its overall portfolio, an official Chinese newspaper said on Tuesday.

The commentary, which was written by an academic and appeared in the overseas edition of the People's Daily, also said that a bigger holding of gold was a crucial building block for the yuan to become an international currency.

Gold has soared to record highs over the past month, in part on expectations that China will step up gold purchases to boost its official reserves of the precious metal.

"Although the return on gold may not be high, its safety is widely acknowledged. We should put safety first in managing our foreign exchange reserves and do our utmost to ensure that we can maintain the value of our current assets," Jing Naiquan, an assistant professor of economics at Zhejiang University, wrote.

He added that the dollar's credibility has been supported over the decades by sizeable U.S. gold reserves, and that gold is an important backstop for all free-floating currencies.

"Having sufficient gold ensures that a currency will gain global acceptance, so the renminbi will inevitably need gold as a guarantor as it goes out to the world," he wrote.

The Chinese-language overseas edition of the People's Daily is a low-circulation offshoot of the domestic paper, which is the official mouthpiece of the ruling Communist Party.

While such a commentary might not directly reflect leadership opinion, its appearance in China's tightly controlled official media suggests the idea of buying more gold has at least some support in elite circles.

However, Hu Xiaolian, a vice-governor of the People's Bank of China, said last week that gold prices were high and that markets should be wary of the formation of an asset bubble.

China said in April that its official gold holdings had risen to 1 054 t from 600 t in 2003, but gold is still a small portion of its $2,27-trillion of foreign exchange reserves, which are mostly invested in dollar-denominated assets.

But China is the world's biggest producer of gold and the government said that its increase in gold holdings in recent years was acquired entirely domestically, not on the international market.

Edited by: Reuters

Monday, December 7, 2009

The Beat Goes On

Another high close by Questrade though.

I have an interesting backup idea

Nonetheless, I always like to look out for backup plan possibilities.

Peggy should try striking up a conversation with Gold Hawk, to discuss either backup strategies or future partnership possibilities. Gold Hawk was almost completely destroyed recently. However, they managed to retain a 15% stake in a near-term operating mine in Peru (Chinese now own the other 85%, and will be funding 100% of the remaining start up costs). Gold Hawk also managed to come of the situation with $15M in cash and no remaining debt.

Gold Hawk recently did a major share rollback, of 25 to 1. They are trading now for $.035, but will likely go to $.88 when the rollback takes effect on December 18, 2009. They will have only 13,071,391 shares outstanding after the rollback.

To stress again, I fully believe that Finskiy and Scola will close off the financing deal with us. They are definitely my first choice. I think Century's share price will be unlimited in the future, with them being the face of Century and with their plan growth strategies. However, Gold Hawk would be a really good backup plan for us, if something should go wrong with the Finskiy and Scola closing. Peggy should talk to them.

I think Century offers excellent possibilities to Gold Hawk shareholders to recover a decent portion of their losses, if a merger were to happen. Century is now trading at $.24. Gold Hawk should be trading at $.88, after rollback. That's a 3.65 ratio. If Century offered 3.65 Century shares for each Gold Hawk share then Century would only have to issue 47.5M new shares in a merger situation with Gold Hawk. Century currently has 226M shares outstanding so a merger with Gold Hawk would only bring the combined outstanding shares up to 273.5M.

Century could then use Gold Hawk's $15M cash plus 1M cash from its current cash position in order to arrive at the $16M cash required to close the deal with the "major international bank" (to access the US$33M).

Thus, we would still end up with $49M (+) in financing to restart Lamaque. Our outstanding share count would only be 273.5M instead of 330.1M (with Finskiy and Scola). In addition, we wouldn't have to issue the 52.5M new warrants. As a result, our FD share count would be in the 285M area as opposed to 393M area.

Century would represent a compelling opportunity for Gold Hawk's shareholders to recover loses, due to the significant upside potential.

Let's say that our financing deal does not close with both Finskiy & Scola and the bank. A merger with Gold Hawk would still be a good idea. The $15M from Gold Hawk plus Century's cash and cash flow over the next 90 days could all go towards paying off Century's debt and net liabilities. It would leave Century completely debt free and net liabilities free. We would get to keep 100% of Lamaque and San Juan. It would finally free up the value of San Juan (as a profitable operating gold mine). It would then allow Century to go out and seek only about $25M in financing to restart Lamaque (on our own sweet terms and our own timing), without being disadvantaged by debt burdens. Century would also have the option of selling the 15% operating stake in the property that comes with Gold Hawk (in order to provide some of the financing).

Friday, December 4, 2009

Century Announces Financing Update

Margaret Kent, President and CEO of Century commented, "Other than finalization of documentation, no other significant business issues remain that affect the closings".

John Williams comments of the US$ pending collapse

I think his views in the following article are a bit too extreme for me, but I agree with his fundamental theories. How the US will financing nearly $5 trillion in 2010 alone without printing a lot of new dollars is way beyond me - when their annual revenues are only $2.1 trillion, and of that money $400 billion automatically goes towards paying down interest on debt, and a lot that annual revenue will already be allocated for annual budgeted operating commitments (they already have problems balancing the annual budget as is).

The article was written by Greg Hunter. Here is the part of the article as it pertains to John Williams:

Dec 4 2009 2:28PM

Ben Bernanke's Hyperinflation And Economic Collapse

In Williams latest report he writes “The United States Economy and Financial System Face an Eventual Great Collapse.” Williams told me in an interview this week that because of all the bailouts, stimulus packages, giveaways and short-term debt, the U.S. has to finance nearly $5 trillion in 2010 alone. That’s about $96 billion in debt auctioned off each and every week!! Williams said, “Someone has to buy those Treasuries, and if no one does, then the Federal Reserve will become buyers of last resort.” The Fed buying that much in Treasuries is the same as printing huge amounts of money. Williams says that “is the tipping point that will start a dollar crisis.” According to Williams, this will produce a “high risk of an ultimate dollar crisis that will begin unfolding in year ahead.”

Inflation created by this “dollar crisis” will turn into hyperinflation within 5 years. Government and Fed actions have caused this problem and Williams sees “no way out,” and “hyperinflation is just a matter of time.” The hyperinflation forecasted by Shadow Government Statistics will look like Weimar Germany in the early 1920’s. The dollar will rapidly lose value to the point it will take a wheelbarrow full of cash to buy a loaf of bread or a gallon of gas. Anyone on fixed income or holding dollars will be wiped out according to Williams.

The Gold market seems to be reflecting the fear of inflation and a weakening dollar. Big central banks are buying Gold. India bought 200 metric tons of the yellow metal last month. Other countries, such as China and Russia, are also gold buyers. Retail investors are, likewise, beginning to flock to gold. Arthur Blumenthal of Stack’s Rare Coins in New York City has been in the gold and coin business since 1974. Stack’s opened its doors in 1934 and is the oldest coin dealer in America. Blumenthal saw the “go-go years” of the late seventies gold market firsthand. Blumenthal told me, “I have never seen anything like this before! There are only buyers.” He says many of his customers are “Wall Street types who are buying physical gold for the first time.”

Williams says buying gold and silver “long term” will be your best defense against a “great collapse…dollar crisis… and hyperinflation.” Williams also says you should stock up on food and other necessary supplies because the coming crisis will create shortages in all sorts of things.

I predict Mr. Bernanke will keep his job at the Federal Reserve. That might be poetic justice because this Fed Chief should witness his handy work firsthand. What is coming to America might go down in history as Ben Bernanke’s Hyperinflation and Economic Collapse.

Thursday, December 3, 2009

Comment from CEO of Newmont about the improvements in access to capital for gold companies

In Century's case, Century has also made significant improvements to its Balance Sheet, couple with operational improvements at San Juan and made significant strides in preparing Lamaque for restart of production (with Lamaque passing stringent bank financing evaluations on every occasion). Century is still trading with heavy discounts. Given it's improved position in this gold environment, it is my view (numbers wise) that Century should not be trading below $.52 right now (regardless of what happens with the financing situation).

Here is what the Newmont CEO had to say:

Higher bullion prices may make it more difficult for the Greenwood Village, Colorado-based company to expand through acquisitions, O’Brien said.

‘Difficult Acquisition Environment’

“With the rise in gold price, a lot of the stocks have rallied, people have access to capital again,” O’Brien said. “It’s probably a more difficult acquisition environment than it was a year ago.”

Newmont will build on its existing deposits and projects while watching for “opportunistic” acquisitions, O’Brien said.

“We’re looking in places around the world where we see terrains of interest,” he said, identifying Indonesia, Australia, Alaska and the Arctic and “challenging” political areas.

“We’re up for the challenge, we just have to find the right discoveries,” O’Brien said.

Wednesday, December 2, 2009

Century Mining Grants Stock Options

Why would Century be hiring all of these people and dishing out cash and options if they didn't see the deal close off well in hand?

Here is the News Release:

BLAINE, WA, Dec. 2 /CNW/ - Century Mining Corporation (CMM: TSX-V) announced today that on November 19, 2009 the Company granted a total of 450,000 stock options, of which 350,000 were granted to a new officer of the Company. The stock options are exercisable into common shares of Century at an exercise price of C$0.20 per share for a period of five years. Century's common shares closed at C$0.20 on the TSX Venture Exchange on November 18, 2009.

Century Mining has 225,987,463 common shares issued and outstanding. Under the terms of the Company's "rolling" Incentive Stock Option Plan, a maximum of 22,598,746 shares are available to be issued pursuant to the exercise of options at this time. Including this grant of 450,000 options, a total of 8,389,750 shares have been reserved for issuance pursuant to outstanding option grants. A further 14,208,996 shares are available for issuance pursuant to future option grants at this time.

With US$1,225 gold and

The $36.75M plus the $21M from the PP would be plenty enough.

Century can even pay an extremely high interest rate on the credit line, say 10% if necessary. It's far better than the market is paying right now. It's better than automatically losing $42M (+) in revenues.

I guess any deal is better than no deal. It's just odd that Finskiy is willing to accept this when he likely has the connections to do something about it. At the very least, Finskiy should renegotiate the deal with the bank, to make it more balanced. Hopefully the delay in closing the deal is related to Peggy and Finskiy trying to firm up a more balanced deal with the bank. Don't get me wrong, I am extremely grateful that the bank has stepped up to the plate for us. I'm just very uncomfortable with this one sided (shark) approach.

I posted an article a few weeks ago about a company that did a deal for a US1,500 hedge price. There is a major difference between US$1,500 and US$541. It's hard to stomach that. I'll try posting it again in the comment area.

Where Have All The Gold Mines Gone?

I think this article provides an appreciation of how valuable our Century Mining assets are right now:

http://www.theaureport.com/pub/na/2479

Source: Brent Cook, Exploration Insights 04/14/2009

Near-Term Production

This year’s corporate mantra for a crowd of junior explorers and miners is quite simple: “get us some near term gold production fast” (or some variation thereof). The motive of course is pure: get the share price up. For companies with $2 million to $200 million in the bank the magic bullet to riches is perceived to be the acquisition of that one gold property or company that everyone else has missed. It’s a simple and easy to understand business plan that doesn’t take a genius to grasp – find it and buy it cheap while no one else is looking. I am personally aware of more than a dozen management teams pursuing this model and there are probably another 50 companies that fall into this category. I have also spent countless hours in the same search and come to the conclusion that everyone else hasn’t missed much. This particular path to corporate riches may turn out to be an elusive dream.

In this mass corporate dream the targeted gold acquisition “only” has to offer low cost production with exploration upside of a few million ounces. It should be located in a politically stable country with welcoming locals eager for the jobs a big hole in the ground will provide. A swimming pool and cold beer are also desirable attributes. Until this stealth opportunity arises, said new gold converts are cutting expenditures and shelving last year’s base metal projects until prices improve. You see, balance sheets alone cannot sustain a share price.

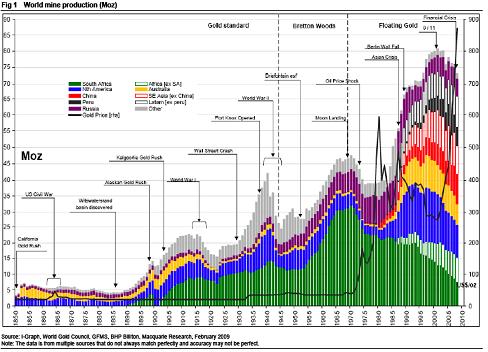

The problem we are all having is that quality economic gold deposits are few and far between. The most obvious confirmation of this claim is that world gold production has been steadily declining since it peaked in 2001 in spite of a nearly US$600 rise in the gold price (fig. 1 below). This goes against basic economic theory that rising prices should bring on more production and suggests a more fundamental problem in the gold industry. To wit, we are mining more gold than we are putting into production in spite of an estimated $US18 billion in gold exploration expenditure over the past five years (CIBC and Metals Economic Group).

(Fig. 1- World gold production. Source; Macquarie Research, 2009)

Global Gold Production: Down

Even more telling in the chart above is that production is declining in the historic major gold mining regions. These prolific regions: USA/Canada, Australia and South Africa have established and workable mining legislation, political stability, infrastructure, experienced mining personnel, access to capital and cold beer. For the most part it appears then that large new gold discoveries are going to come lacking at least one of the advantages just listed. This ultimately means that the deposits are going to have to offer significantly higher profit margins to compensate for the increased risks. It also means the timeline to production will more often than not be stretched over many years as political, bureaucratic and social issues are ironed out—or not. Needless to say, borrowing to build a billion dollar project in someplace like…say Angola, is going to be problematic even when the credit markets unfreeze. Net-net, gold production is unlikely to increase over the next several years at least.

Company Production: Down

There are more or less 30 major gold mining companies and untold junior companies that contribute to the roughly 74 million ounces of annual gold production. Many of the major mining companies are not keeping up with reserve replacement at their mines and are also showing declining production and reserve profiles. They have predominately been able to add ounces through acquisitions and by raising the gold price used in reserve calculations: essentially turning waste to ore. This increased gold price assumption directly translates into a lower average recovered grade and higher production costs. Margins are not expanding as one would expect due to the miners’ inability to add new high-grade reserves. CIBC World Markets calculates a four-year world recovered gold grade decline from 1.7g/t in 2004 to 1.4g/t in 2008. That’s about an $8.70 decline in the value of every tonne of ore blasted, hauled and processed.

On the acquisition side, much of the increased gold production and reserves has come by way of base metal production. When base metal prices were high, gold company production costs were lower and earnings strong due to the base metal credits. The collapse in base metal prices at the end of 2008 resulted in a remarkable 31% increase in gold production costs, according the World Gold Council figures. Lesson learned: henceforth, gold dominant deposits will command a premium.

Recognizing this lack of economic gold deposits there is a concerted effort afoot by the financial movers and shakers to cob a collection of smaller gold (and silver) producers together, creating larger producers. The idea is to tout these newly created mid-tier producers with increased “visibility” to a fresh and better-heeled audience (some might say suckers). Although this exercise will undoubtedly make money for the suits, brokers, and some shareholders, this can be more of a shell game than real wealth creation. The resultant new gold production is generally marginal at best and those buying into and financing said vehicles must make a conscious decision as to how many warts they are willing to overlook.

Experienced Explorers: Down

I have commented on the declining metal production and the 120 or so mine closures or delays previously. Layoffs within the industry are even worse now and are especially hard on the exploration end of the business. Major and junior companies are all cutting staff and contractors: Rio Tinto-14,000 gone; TeckCominco-1,400 gone; BHP-6,000 gone; Morenci Mine-1,550 gone; Stillwater-528 gone; Shore Gold-89 gone and the list goes on right down to the smallest exploration company.

Newmont Mining, “the company of choice”, is a particularly sad story. They recently raised $1.2 billion through equity and convertible notes at the same share price they traded at five years ago (see fig. 2 below). Keep in mind that over the past five years the gold price increased about $500 and they produced around 27 million ounces of gold. Newmont has fallen under the influence of accountants who are reorganizing the company (again) into four new “business centers” none of which are reporting to the VP exploration. They laid him off plus a good number of the exploration staff. Newmont’s five years of absolutely zero added shareholder value (price) despite a near doubling of the gold price points to the problem the industry as a whole faces finding new quality deposits. The fact that Newmont is cutting exploration staff suggests they don’t hold out much hope for future in-house discoveries.

(Fig. 2- Newmont Mining 5-year price chart)

We could easily see 25% of the mining industry out of work, which is a real shame given my next sentence. The pent up demand for near term gold production is not going to be satisfied through financial engineering. There are not enough economic gold deposits to go around, I’ve been looking. With declining metal prices and profits; decreased exploration staff and budgets; and increased exploration, development and production costs and timelines, the odds are stacked against a surge in new gold discoveries.

Who will make the Next Discoveries?

Nearly all the hard global economic statistics and gold supply-demand data I see points toward gold and gold companies being amongst the best performing investments over the next few years. Notwithstanding the time and effort involved, increased gold production will to a large degree have to come from new discoveries; we cannot keep kicking the same old dog properties. And, in spite of the hopes and wishes of many in the industry, sufficient cheap ready-to-go deposits just don’t exist. Given the profound difficulty of finding new gold deposits, the few lucky junior companies that are able to come up with a real gold discovery will reap dramatic share price increases.

The unlucky majority of juniors however are in for some bona fide rough times in finance world. Risk capital is tight and minerals exploration is a capital-intensive business: no capital-no business. So despite the need for new discoveries, we are going to witness the demise of many junior explorers as investors’ hopes fall in tandem with the share prices. I do not anticipate a sudden rush of money into the exploration sector that will raise all boats and certainly wouldn’t base any investments on that premise. Anyone subsidizing mediocre or low potential gold projects is probably doomed from the outset.

There is however no doubt that new gold deposits will be found. They are going to come from the hungry, intellectually astute and well-financed junior exploration companies, most of whom you have never heard of. The successful company management teams will be comprised of motivated people who are anxious to make their name in the mining industry. They will be bringing new ideas to old areas and old ideas to new areas. It is therefore imperative to focus on what appear to be legitimate, major gold discoveries and under-appreciated gold resources. Guessing won’t work in this market: economic and geologic reality is key.

Tuesday, December 1, 2009

In my view, numbers wise, no reason for the share price to trade below $.52 per share, even without any additional financings

However, let's work with worst case scenario for this analysis. Let's see what we are working with if we do not get another financing - strictly hypothetically speaking.

Century's remaining balance sheet obligations:

*Net AP and Accrued Liabilities - $5.6M (net of $8.3M AR and est. employee pymt of $350K made subsequent to quarter end)

*IQ Debt - $16.4M

*MRI Debenture - $1.0M (Century is trying to reduce this due to MRI's failure to fulfill its obligation)

*Tamerlane - $153K

*Current Other LT Debt (Equip. lease) - $340K

*Other LT Debt (Equip. lease) - $241K

*Future Income Tax Liabilities - $635K ($935K less $300K per Quebec newspapers, this amount appears to have been paid subsequent to quarter end, municipal taxes, etc.)

NET remaining Century Balance Sheet obligations (before adjusting for cash position) = $24.3M

I have excluded the $2.6M ($2.2M + $.4M) Gerald Metals obligation as they are already secured by the 2,015 unfinished ounces residing in Lamaque's inventory)

Naturally, I have also excluded the environment bond amount, as we already know about the Quebec payment subsequent to quarter end.

Cash sitution (let's assuming no more financings, not even the current $4M to be closed off soon):

*Current cash - $2.0M (likely, based on previous $4M financing and recent Cash Flow)

*New cash next 90 days - $2.0M (assuming Q3 production of 4,561 and US$486 cash cost, even after removing funds for Corp G&A, ongoing mine development, taxes, etc.)

Cash Position next 90 days = $4.0M

NET remaining Century Balance Sheet obligations (After adjusting for cash position):

$20.3M ($24.3M - $4.0M)

Century's share price based on Q3's Net Income:

Century posted a Net Income of $.012 per share in Q3 (equates to $.048 on an annualized basis), even using Century's current share count of 226,000,000. There is every reason to believe that this Net Income level is sustainable. The gold price has gone from a Q3 average of US$960 to US$1,200 currently. With a capital injection of US$1.5 to expand San Juan's milling capabilities, Century's quarterly production ounces can increase from the Q3 level of 4,561 to 6,500.

Using a conservative PE (Price to Earnings) ratio of 10, this equates to a Century share price of $.48 (this is even without Lamaque in production).

Let's assume we had to sell Lamaque (again, strictly hypothetically speaking, from a worst case scenario perspective):

By the way, I am aware of at least 2 solid companies that were interested in executing a merger with Century (prior to Century going with Finskiy and Scola) so there is definitely interest in Lamaque out there - Century confirmed via several documents and conference calls that other parties have showed interests in doing a deal with Century. One would think that those interests would be even more favourable to Century now that the gold price is US1,200 (with higher potential).

Let's further assume fire sale price scenarios.

Scenario 1, sale price = $30M for Lamaque

Scenario 2, sale price = $50M for Lamaque

Scenario 3, sale price = $70M for Lamaque

Scenario 4, sale price = $100M for Lamaque

Remaining cash after retirement of the $20.4M balance sheet obligation:

Scenario 1 = $9.7M or $.04 per share cash remaining

Scenario 2 = $29.7M or $.13 per share cash remaining

Scenario 3 = $49.7M or $.22 per share cash remaining

Scenario 4 = $79.7M or $.35 per share cash remaining

Share price (Q3 Net Income level + remaining Cash from transaction):

Scenario 1 = $.52 per share ($.48 + $.04)

Scenario 2 = $.61 per share ($.48 + $.13)

Scenario 3 = $.70 per share ($.48 + $.22)

Scenario 4 = $.83 per share ($.48 + $.35)

In my view, (numbers wise) I see no reason for Century trading as low as $.26 per share right now, with or without any future financings. The improvements in the Balance Sheet over the past year, coupled with the gold environment, has reduced the risks substantially, in my view.

Outlook, from MD&A

The last number published for Lamaque was 5.5M ounces (June'09). Is the over 6.0M currently for Lamaque a typo? Or, have they added ounces since June'09. Perhaps they adjusted it to reflect the lower cutoff grade (from 2.5 g/t to 2.1 g/t - going from using US$800 gold price to US$900), as I've been anticipating they will eventually. If the current Lamaque number is truly over 6.0M then the overall company number might be close to 6.5M currently (when adding in SJ). I guess we'll see eventually.

The combined production forecast of both mines when Lamaque is at capacity will be over 130,000 ounces per year at cash cost of US$450-US$500 per ounce.

We are probably talking about a couple of years down the road. I take it the break down will be 100,000 for Lamaque and 30,000 for San Juan. They can only set the targets based on the 1.3M current reserves. What's interesting is that the majority of the 2.6M ounces residing 1000 ft (300 meters) of the surface have not been moved into P&P Reserves as yet. Century has launched a $4M exploring program. This should allow more of the 2.6M ounces to be moved into higher resource categories, including P&P Reserves. If a larger number of those ounces are moved into P&P Reserves then hopefully the company will look to fast track production to the 100,000 per year level at Lamaque. Also, hopefully they will look to increase the long term production target beyond 100,000 (mill capacity is in place to handle much higher production). Given the proximity to the surface, theoretically, mine development and mining of these ounces should be independent of dewatering the lower levels and refurbishing the shafts (required to drill and mine the areas below 1200 ft) - assuming there is sufficient space to maneuver around for all initiatives.

First thing is first though, we need to close off the financings then we need to establish profitable production at Lamaque. The US1,200 (+) gold price will be extremely helpful.

From the MD&A:

"The outlook for Lamaque technically is exceptional. The Company continues to add ounces to the Lamaque resource base and with combined reserves and resources currently over 6 million ounces of gold the mine should be a significant producer for many years to come. The combined production forecast of both mines when Lamaque is at capacity will be over 130,000 ounces per year at cash cost of US$450-US$500 per ounce. Management has continued to focus on the technical aspects of the project and has continued to support the group of employees and staff at the mine through this difficult time. The fact that the project successfully passed the stringent due diligence process is evidence that the project is robust and is ready to restart when the financing is closed."

"The outlook for San Juan is also positive, but San Juan can only achieve its production goals for 2010 when capital needed to complete the refurbishment of the milling facilities is available. Until closing of the larger financings, cash continues to flow from Peru to support management and head office expenses, leaving the necessary mill expansion and other cost saving efforts unfunded."

"The Company’s assets at Lamaque and San Juan are very good projects and the potential to realize significant shareholder value from these existing assets is excellent. Management’s focus is to work diligently to close the announced financing packages by the middle of December. This will ensure that the Company’s working capital deficit is eliminated, and the necessary start up and expansion work is completed at the Lamaque and San Juan mines. When this happens the company will have two long life assets that have the potential to generate substantial cash flow at current and projected gold prices. Until then, the Company will not be completing any further acquisitions or be spending any corporate cash flow on its other existing development projects."

"With gold approaching US$1,200 per ounce and the Company is ready to restart the Lamaque project the outlook for the Company has improved significantly. Management looks forward to a robust year in 2010 as we work to implement all the Company’s growth plans."

Monday, November 30, 2009

Q3 Financials Filed

Some really positive developments today! The only condition for closing the $21 million PP that I thought might be a bit dicey after the recent bad press in Quebec was the renegotiation of the IQ debt. The deal reached under that political cloud was amazing. (One Quebec MP called Century a company they despised). I would have been happy with shares priced at 25 cents (the same deal as the other creditors received). For the past year where we have been most vulnerable was someone else buying the IQ debt and foreclosing on us. As Production said, IQ has treated Century extremely well.

I'll post today's trades in detail after this and will try to keep the "Today's Trades" link current from now on as it now appears we are back in business.

3rd Quarter results

>

In the third quarter ended September 30, 2009 the Company reported an operating profit from mining operations, before depreciation, amortization and accretion, of $2,334,568 (2008 - $1,735,994) from gold revenues of $4,532,083 (2008 - $4,300,640). Expenses incurred in the mining operations were $2,197,515 (2008 - $2,564,646). For the quarter ended September 30, 2009 the Company reported net income of $2,689,470 or $0.01 per share, compared to net income of $607,382, or $0.004 per share in the prior period.

As at September 30, 2009 the Company had a working capital deficiency of $5,830,238 compared to a working capital deficiency of $14,985,245 at December 31, 2008, a decrease of 38%. The Company is working diligently to continue to reduce this deficit.

During the third quarter of 2009, the Company announced the signing of a term sheet for a US$33million prepaid gold forward sale to a major international bank with a significant gold trading business. This term sheet was conditional on a $20 million dollar equity offering. Consequently the Company signed a non binding term sheet with Gravity/Kirkland for a $21million dollar private placement. It is expected that these financings will close in mid December. In total the new financing will be providing the Company with $56 million dollars of new money to start up the Lamaque project. In addition to these financings, the Company has an arrangement with Investissement Québec to buy out their note for $8.75 million dollars and 5 million shares of Century.

In the third quarter the Company completed a flow-through private placement for $1.1 million. Two additional flow-through private placements in the amounts of $1.3 million and $2.7 million were completed in October and November.

The 2010 forecasted production from the Lamaque and San Juan is estimated to be 70,000 ounces. The cash cost at San Juan is expected to be similar to that in 2009. Lamaque's production costs will be capitalized until such time that the project reaches commercial production levels as defined under Canadian GAAP.

Margaret Kent, President and CEO of Century commented, "As we have discussed in our MD&A, the worst times are behind us. Our financing plans that we will be closing in mid-December will be accretive to our shareholders and insure over time that all our creditors will be paid in full. Our Peru operation continues to be cash flow positive and we look forward to reinvesting the cash generated from the operation to expand production".

Ms. Kent further commented, "The Company has worked diligently to reduce its working capital deficit. The year end financial statements, which will reflect the closing of the proposed financings will show a significant reduction in the Company's liabilities".

About Century Mining Corporation

Century Mining Corporation is a junior gold producer. The Company owns and is working towards the start up of the Lamaque mine in Québec that historically has produced over 9.2 million ounces of gold. In Peru, Century wholly-owned subsidiaries own an 82.6% interest in the San Juan Mine where the Company accounts for 100% of gold production. Total gold production for 2007 and 2008 was 63,124 and 14,252 ounces of gold, respectively.

Repurchase of LT debt from IQ

Blaine, WA, Nov. 30 /CNW/ - Century Mining Corporation (CMM: TSX-V) announced that it has reached agreement in principle with Investissement Quebec for the repurchase of the long-term note held by Investissement Quebec. In exchange for payment of $8,750,000 in cash and the issuance of 5,000,000 common shares in the Company, Investissement Quebec has agreed to discharge the Company from all obligations under the note and to release all of its security interests in the property of the Company. Funding for the transaction will come from the debt and equity financings recently announced by the Company which are scheduled to close in early December. Also from the closing of the debt and equity financings the Company's working capital gold facility with Gerald Metals will be paid out. After the closing, the Company's only long-term debt will be the $33 million prepaid gold forward facility.

"Over the last several weeks and months, we have methodically taken the right steps towards the reopening of the Lamaque underground project. The repurchase of the note from Investissement Quebec is another major step forward in our financing and development plans" said Margaret Kent, President and CEO, Century Mining Inc.

The Company also announced the following management appointments:

Hugh W. Blakely, C.A., B.C. - is appointed to the position of Chief Financial Officer, effective November 18, 2009. Blakely was most recently Interim Chief Financial Officer of Canadian Royalties Inc. Previously, he held the position of Senior Vice-President and Chief Financial Officer of Heico's Canadian steel operations, operating under the name of Ivaco (formerly Ivaco Inc, a public company). During his tenure at Ivaco Inc, Mr. Blakely held a number of senior financial positions and worked in tandem with the Chief Restructuring Officer and Ivaco's financial advisors in managing the restructuring and sale of the businesses to Heico. He earned his Bachelor of Commerce from Concordia University and began his career with Coopers & Lybrand in Montreal and obtained his C.A. designation in 1974. Mr. Blakely is a solid professional with deep financial skills bringing over 30 years experience to Century.

Richard B. Meschke, J.D., M.B.A., B.A. - is promoted from Chief Financial Officer to Vice President, Legal and Corporate Development, where he will be leading the Company's major contract negotiations and growth and acquisition programs. Mr. Meschke has extensive experience completing acquisitions, optimizing operations and negotiating contracts in the mining industry. During 20 years with AMAX Inc., a major metals and energy company, and its successor, Cyprus Amax Minerals Company, Mr. Meschke held executive positions with finance, business development and operating responsibilities. His accomplishments include completion of more than $.5 billion in acquisitions and divestitures, and negotiation of long-term contracts representing in excess of $300 million in annual revenues. He also worked in the engineering and construction industry where he negotiated contracts up to $100 million in value. Mr. Meschke earned a B.A. from Wabash College, an M.B.A. from the University of Michigan and a law degree from Indiana University.

Peter A. Ball - will be joining the Company as Director, Investor Relations in early December 2009. Mr. Ball is a graduate of the Mine Engineering Program, Haileybury School of Mines and the Canadian Securities Program. Mr. Ball comes to Century with over 20 years experience in the resource industry, most recently at Hawthorne Gold Corp. and previously with El Dorado Gold Corp. He is well versed in corporate communications, public relations, engineering, business development initiatives, investor relations, marketing, finance and securities.

Margaret Kent, President and CEO of Century commented, "The Company has a very bright future, and over the coming months we plan to rebuild our corporate management and add staff to execute the Lamaque project. We are pleased to welcome Hugh and Peter to our team."

Anonymous and Canaccord at it again

I have no idea where they got that many shares from. Most of the shares have been accounted for from PP's previous to this year, for example:

*Scion - they sold primarily during tax loss periods, and I do not recall Canaccord picking up a significant number of those shares

*Wega - their selling is vividly embedded in my mind (ugly period). Canaccord and Anonymous were anything but buyers. In fact, they piled on with the selling, in a massive way - almost as if someone was trying to break the company.

*The New York PP - almost all of those shares were sold by the NY investors directly to Peggy and Ross via a private transaction

*Late 2007 and early 2008 financings - we saw most of those shares sold by GMP, and we didn't see Canaccord making purchases

The only financings unaccounted for since 2005 are the $.13 - $.14 financings earlier in this year. It's not clear if Canaccord got their hands on any of those shares.

Friday, November 27, 2009

Upgraded from 3 star to a 4 star by TD

| The 5-Star Rating of Century Mining Corp. (CMM-X) has changed | |||

| 5-Star rating (new): | **** | 5-Star rating (previous): | *** |

Lamaque will shine

I think people forget that Lamaque has produced 9,287,450 ounces of gold since 1935 (almost entirely from the underground). A property cannot be that successful, for that period of time (including during periods of low gold prices), and not be world class and distinguished.

Quite often, the best places to find gold discoveries are places where gold has been mined successfully before. Right now, some of the greatest success stories in the world are located on properties with former production (along prominent gold belts in Canada - similar to Lamaque).

I posted this a few months ago, but I thought it's a good point to make again. It profiles the humble beginnings of 3 hugely successful Canadian mines/properties. I especially like the story of Goldcorp's Red Lake Mine. Also, that story reminds me of Lamaque's situation the most. The Red Lake Mine was left for dead at one point, but Goldcorp saw the potential and challenged that thinking. What is it now, the world's most highly regarded mine?

The other 2 mines profiled are Detour Gold's Detour Lake Mine and Osisko's Malartic Mine. Detour Gold (originally Pelangio) started with nothing and now its market cap is $1.2 billion. Same with Osisko, from nothing to $2.2 billion in market cap.

It is my belief that Lamaque will go down a similar path to these 3 mine/companies.

1) Goldcorp’s Red Lake Mine

“1994: Red Lake Mine was a marginal operation that been in continuous operation since 1948. It had been starved of capital and its performance had always been overshadowed by Campbell. Conventional wisdom said the Red Lake was finished, but Goldcorp challenged this belief at the beginning of 1995 when a $7 million exploration program was initiated that lead to the discovery of a high grade zone of gold mineralization.”

“1995: Significant discovery announced at Red Lake – nine holes averaging 311.31 grams of gold per tonne across 2.3 metres. The mineralization was discovered at a depth and location previously thought to have no potential.” The rest is history, right?

I believe Goldcorp used a similar modeling technique and approach (to assist with their exploration efforts) that Century is using with Lamaque right now.

2) Detour Lake

“The Detour Lake joint venture consists of the wholly owned exploration lands and the mine option lands covering the former Detour Lake mine which produced 1,764,985 ounces of gold during its 17-yearhistory.

How successful has Detour Gold’s exploration program been? Detour Gold currently has 13,200,000 of 43-101 ounces.

3) Osisko Exploration

“November 8, 2004: “The Canadian Malartic property includes the former Canadian Malartic Mine which produced over 1 million ounces of gold at an average grade of 3.37 g/t Au between the years 1935 - 1965. Historical production in the Malartic camp from 1935 to 1979 (Canadian Malartic and the adjacent Barnat-Sladen and East Malartic Mines) totaled over 5 million ounces (figures obtained from public data base of the Ministere des Ressources Naturelles du Quebec).”

“November 23, 2004: “…..announce results of the preliminary review of acquired technical documentation on its recently optioned Canadian Malartic property, Quebec. The review indicates that the Canadian Malartic property has a reported historical resource of over 500,000 ounces gold contained within several near-surface deposits.”

How successful has Osisko’s exploration program been? Osisko currently has 10,010,000 of 43-101 ounces.