I think this article provides an appreciation of how valuable our Century Mining assets are right now:

http://www.theaureport.com/pub/na/2479

Source: Brent Cook, Exploration Insights 04/14/2009

Near-Term Production

This year’s corporate mantra for a crowd of junior explorers and miners is quite simple: “get us some near term gold production fast” (or some variation thereof). The motive of course is pure: get the share price up. For companies with $2 million to $200 million in the bank the magic bullet to riches is perceived to be the acquisition of that one gold property or company that everyone else has missed. It’s a simple and easy to understand business plan that doesn’t take a genius to grasp – find it and buy it cheap while no one else is looking. I am personally aware of more than a dozen management teams pursuing this model and there are probably another 50 companies that fall into this category. I have also spent countless hours in the same search and come to the conclusion that everyone else hasn’t missed much. This particular path to corporate riches may turn out to be an elusive dream.

In this mass corporate dream the targeted gold acquisition “only” has to offer low cost production with exploration upside of a few million ounces. It should be located in a politically stable country with welcoming locals eager for the jobs a big hole in the ground will provide. A swimming pool and cold beer are also desirable attributes. Until this stealth opportunity arises, said new gold converts are cutting expenditures and shelving last year’s base metal projects until prices improve. You see, balance sheets alone cannot sustain a share price.

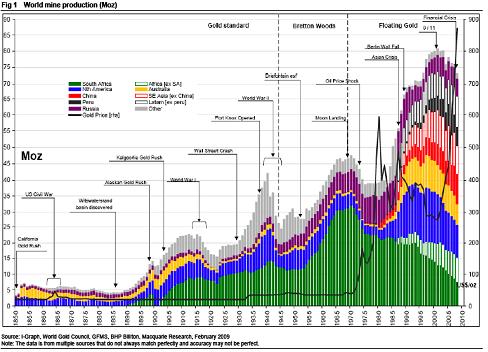

The problem we are all having is that quality economic gold deposits are few and far between. The most obvious confirmation of this claim is that world gold production has been steadily declining since it peaked in 2001 in spite of a nearly US$600 rise in the gold price (fig. 1 below). This goes against basic economic theory that rising prices should bring on more production and suggests a more fundamental problem in the gold industry. To wit, we are mining more gold than we are putting into production in spite of an estimated $US18 billion in gold exploration expenditure over the past five years (CIBC and Metals Economic Group).

(Fig. 1- World gold production. Source; Macquarie Research, 2009)

Global Gold Production: Down

Even more telling in the chart above is that production is declining in the historic major gold mining regions. These prolific regions: USA/Canada, Australia and South Africa have established and workable mining legislation, political stability, infrastructure, experienced mining personnel, access to capital and cold beer. For the most part it appears then that large new gold discoveries are going to come lacking at least one of the advantages just listed. This ultimately means that the deposits are going to have to offer significantly higher profit margins to compensate for the increased risks. It also means the timeline to production will more often than not be stretched over many years as political, bureaucratic and social issues are ironed out—or not. Needless to say, borrowing to build a billion dollar project in someplace like…say Angola, is going to be problematic even when the credit markets unfreeze. Net-net, gold production is unlikely to increase over the next several years at least.

Company Production: Down

There are more or less 30 major gold mining companies and untold junior companies that contribute to the roughly 74 million ounces of annual gold production. Many of the major mining companies are not keeping up with reserve replacement at their mines and are also showing declining production and reserve profiles. They have predominately been able to add ounces through acquisitions and by raising the gold price used in reserve calculations: essentially turning waste to ore. This increased gold price assumption directly translates into a lower average recovered grade and higher production costs. Margins are not expanding as one would expect due to the miners’ inability to add new high-grade reserves. CIBC World Markets calculates a four-year world recovered gold grade decline from 1.7g/t in 2004 to 1.4g/t in 2008. That’s about an $8.70 decline in the value of every tonne of ore blasted, hauled and processed.

On the acquisition side, much of the increased gold production and reserves has come by way of base metal production. When base metal prices were high, gold company production costs were lower and earnings strong due to the base metal credits. The collapse in base metal prices at the end of 2008 resulted in a remarkable 31% increase in gold production costs, according the World Gold Council figures. Lesson learned: henceforth, gold dominant deposits will command a premium.

Recognizing this lack of economic gold deposits there is a concerted effort afoot by the financial movers and shakers to cob a collection of smaller gold (and silver) producers together, creating larger producers. The idea is to tout these newly created mid-tier producers with increased “visibility” to a fresh and better-heeled audience (some might say suckers). Although this exercise will undoubtedly make money for the suits, brokers, and some shareholders, this can be more of a shell game than real wealth creation. The resultant new gold production is generally marginal at best and those buying into and financing said vehicles must make a conscious decision as to how many warts they are willing to overlook.

Experienced Explorers: Down

I have commented on the declining metal production and the 120 or so mine closures or delays previously. Layoffs within the industry are even worse now and are especially hard on the exploration end of the business. Major and junior companies are all cutting staff and contractors: Rio Tinto-14,000 gone; TeckCominco-1,400 gone; BHP-6,000 gone; Morenci Mine-1,550 gone; Stillwater-528 gone; Shore Gold-89 gone and the list goes on right down to the smallest exploration company.

Newmont Mining, “the company of choice”, is a particularly sad story. They recently raised $1.2 billion through equity and convertible notes at the same share price they traded at five years ago (see fig. 2 below). Keep in mind that over the past five years the gold price increased about $500 and they produced around 27 million ounces of gold. Newmont has fallen under the influence of accountants who are reorganizing the company (again) into four new “business centers” none of which are reporting to the VP exploration. They laid him off plus a good number of the exploration staff. Newmont’s five years of absolutely zero added shareholder value (price) despite a near doubling of the gold price points to the problem the industry as a whole faces finding new quality deposits. The fact that Newmont is cutting exploration staff suggests they don’t hold out much hope for future in-house discoveries.

(Fig. 2- Newmont Mining 5-year price chart)

We could easily see 25% of the mining industry out of work, which is a real shame given my next sentence. The pent up demand for near term gold production is not going to be satisfied through financial engineering. There are not enough economic gold deposits to go around, I’ve been looking. With declining metal prices and profits; decreased exploration staff and budgets; and increased exploration, development and production costs and timelines, the odds are stacked against a surge in new gold discoveries.

Who will make the Next Discoveries?

Nearly all the hard global economic statistics and gold supply-demand data I see points toward gold and gold companies being amongst the best performing investments over the next few years. Notwithstanding the time and effort involved, increased gold production will to a large degree have to come from new discoveries; we cannot keep kicking the same old dog properties. And, in spite of the hopes and wishes of many in the industry, sufficient cheap ready-to-go deposits just don’t exist. Given the profound difficulty of finding new gold deposits, the few lucky junior companies that are able to come up with a real gold discovery will reap dramatic share price increases.

The unlucky majority of juniors however are in for some bona fide rough times in finance world. Risk capital is tight and minerals exploration is a capital-intensive business: no capital-no business. So despite the need for new discoveries, we are going to witness the demise of many junior explorers as investors’ hopes fall in tandem with the share prices. I do not anticipate a sudden rush of money into the exploration sector that will raise all boats and certainly wouldn’t base any investments on that premise. Anyone subsidizing mediocre or low potential gold projects is probably doomed from the outset.

There is however no doubt that new gold deposits will be found. They are going to come from the hungry, intellectually astute and well-financed junior exploration companies, most of whom you have never heard of. The successful company management teams will be comprised of motivated people who are anxious to make their name in the mining industry. They will be bringing new ideas to old areas and old ideas to new areas. It is therefore imperative to focus on what appear to be legitimate, major gold discoveries and under-appreciated gold resources. Guessing won’t work in this market: economic and geologic reality is key.

No comments:

Post a Comment